Why Do You Need Car Insurance?

Of course, every driver needs car insurance in order to legally operate a motor vehicle. This is generally accepted by most people as something that just have to be, but for the curious ones out there that want to know exactly why they need to have car insurance, this article is for you. Hopefully this can help you understand why it is necessary, and why you should try to find an insurance company that completely covers your financial liability.

Of course, every driver needs car insurance in order to legally operate a motor vehicle. This is generally accepted by most people as something that just have to be, but for the curious ones out there that want to know exactly why they need to have car insurance, this article is for you. Hopefully this can help you understand why it is necessary, and why you should try to find an insurance company that completely covers your financial liability.

Paying For Damages

Damages that are caused by a car accident usually rise up to several thousand dollars, which is a lot more than most people have in their bank accounts. Not only that, but even if they did manage to somehow have several thousand in their account, it would definitely hurt their savings to have to shuffle that money out for an a...Read More

The WVGazette.com reported on Dec 10, 2013

The WVGazette.com reported on Dec 10, 2013  No matter how toned your driving skills are, there is always the chance that you will get into a car accident. It may not even be your fault, which shows just how unavoidable it really is. People make mistakes, and you need the financial liability to protect you should you make this mistake or it is made by somebody else. What are you supposed to do should this happen?

No matter how toned your driving skills are, there is always the chance that you will get into a car accident. It may not even be your fault, which shows just how unavoidable it really is. People make mistakes, and you need the financial liability to protect you should you make this mistake or it is made by somebody else. What are you supposed to do should this happen? As automobile insurance is a requirement for everyone in the United States, millions of people look for the best rates in the car insurance field each month. With the special promotions from certain car insurance companies competing against one another to the cheaper rates that are found through online auto insurance companies, there are many ways to going about finding the right automobile insurance company th...

As automobile insurance is a requirement for everyone in the United States, millions of people look for the best rates in the car insurance field each month. With the special promotions from certain car insurance companies competing against one another to the cheaper rates that are found through online auto insurance companies, there are many ways to going about finding the right automobile insurance company th... If you are paying a high amount for your car insurance each month, it is no wonder that you want to try and figure out how to reduce the amount that you pay each month. It doesn’t have to be difficult to get your insurance at a reduced rate; you just have to know how to do it. With that in mind, let’s look at some of the different methods that you can use to reduce your insurance costs and save money.

If you are paying a high amount for your car insurance each month, it is no wonder that you want to try and figure out how to reduce the amount that you pay each month. It doesn’t have to be difficult to get your insurance at a reduced rate; you just have to know how to do it. With that in mind, let’s look at some of the different methods that you can use to reduce your insurance costs and save money. You are speeding down the freeway at 75 mph to try and get to work on time, but you suddenly see flashing lights behind you. Instantly, you know that you are being pulled over. You silently curse under your breath and get to the side of the road. Of course, driving that fast has gotten you a pretty expensive ticket, which the officer writes up. He gets in his car and drives off. Now what?

You are speeding down the freeway at 75 mph to try and get to work on time, but you suddenly see flashing lights behind you. Instantly, you know that you are being pulled over. You silently curse under your breath and get to the side of the road. Of course, driving that fast has gotten you a pretty expensive ticket, which the officer writes up. He gets in his car and drives off. Now what? If you have looked into getting an insurance policy for your teenager, you have probably found out that it actually costs you more each month to protect their financial liability than it would cost for yourself. This isn’t something that is specific to your insurance agency; this is the way that every insurance agency works. Why should someone have to pay more just because they are younger?

If you have looked into getting an insurance policy for your teenager, you have probably found out that it actually costs you more each month to protect their financial liability than it would cost for yourself. This isn’t something that is specific to your insurance agency; this is the way that every insurance agency works. Why should someone have to pay more just because they are younger? t was announce through Big Independent Group (BIG), an insurance industry group in California, that Alliance United has issued their one millionth policy. The statement read

t was announce through Big Independent Group (BIG), an insurance industry group in California, that Alliance United has issued their one millionth policy. The statement read Most teenagers cannot wait to turn 16 and be qualified to earn their drivers license. For parents it can be a welcome development since the teenage driver can now take over many of the driving tasks necessary in connection with their school or recreational activities. But in general, it can be rather expensive to obtain car insurance coverage for a younger driver. So here are some suggestions to help you to find the most cost effective coverage for your teen.

Most teenagers cannot wait to turn 16 and be qualified to earn their drivers license. For parents it can be a welcome development since the teenage driver can now take over many of the driving tasks necessary in connection with their school or recreational activities. But in general, it can be rather expensive to obtain car insurance coverage for a younger driver. So here are some suggestions to help you to find the most cost effective coverage for your teen. Chicago-based QuotePro has announced their expansion into 38 States with their Retail Website Solution. Quotepro Technology allows online consumers to price shop and purchase Auto Insurance 24/7/365.

Chicago-based QuotePro has announced their expansion into 38 States with their Retail Website Solution. Quotepro Technology allows online consumers to price shop and purchase Auto Insurance 24/7/365. Illinois is now poised to raise mandatory auto insurance minimums. An article in the Chicago Tribune on May 28th reported, "

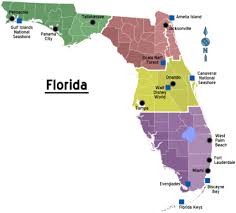

Illinois is now poised to raise mandatory auto insurance minimums. An article in the Chicago Tribune on May 28th reported, " Brevardtimes.com reported today1 that there are disparities in the premiums being paid by auto insurance based on your zip code in Florida with Miami residents paying up to $2632 and the lowest was reported to be $1043 in Gainseville.

Brevardtimes.com reported today1 that there are disparities in the premiums being paid by auto insurance based on your zip code in Florida with Miami residents paying up to $2632 and the lowest was reported to be $1043 in Gainseville.  On July 4, 2013 the Chicago Tribune reported that IL is set to raise

On July 4, 2013 the Chicago Tribune reported that IL is set to raise